It is with great anticipation and delight that I look forward to meeting the author of a book I am reading, The Reluctant Shaman by Kay Cordell Whitaker. She is currently on a tour, promoting her new book Sacred Link, and is scheduled to be at East West Bookstore in Mountain View on October 28th and Black Oak Books in Berkeley on Sunday, October 30. Kay’s full schedule is at her web site, A World In Balance.

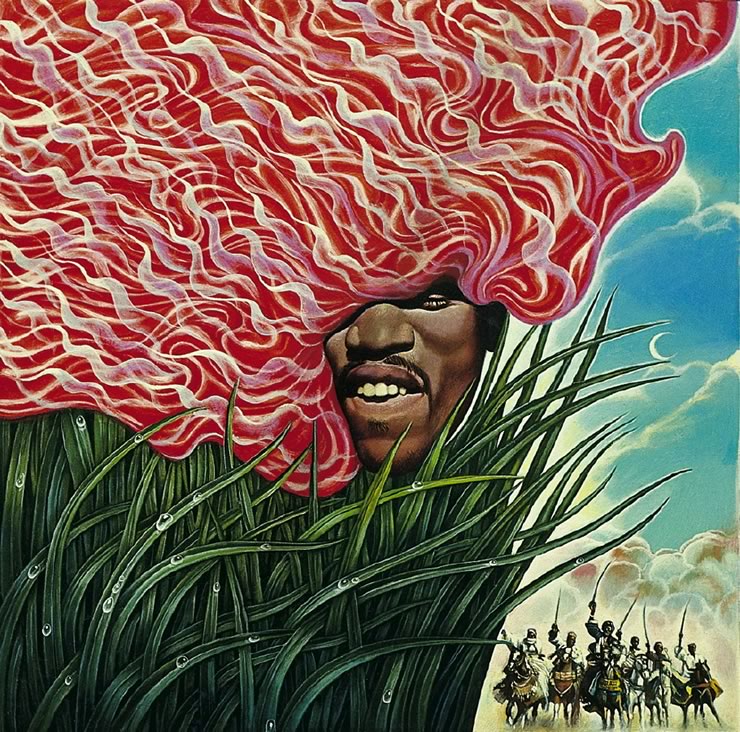

My first introduction to writings on shamanism were the Carlos Castaneda books descibing his travels into the Mexican desert and apprenticeship under the mysterious Yaqui Indian teacher, don Juan Mateus. Unlike Castaneda’s experience, Whitaker’s Peruvian teachers, Chea and Domano Hetaka, introduced themselves and taught her on her home turf in Santa Cruz, California. Whitaker’s writing is far more accessible than Castaneda’s including practical homework lessons given to her in logical steps by her teachers. Castaneda gave much attention to building personal power in order to escape the bounds of the ordinary world of reality. The Hetekas express a greater mission through their teachings: by finding your own song, you contribute to awakening society in order to bring about global healing. Spiritual joys experienced along the way just happen to be a plus.

descibing his travels into the Mexican desert and apprenticeship under the mysterious Yaqui Indian teacher, don Juan Mateus. Unlike Castaneda’s experience, Whitaker’s Peruvian teachers, Chea and Domano Hetaka, introduced themselves and taught her on her home turf in Santa Cruz, California. Whitaker’s writing is far more accessible than Castaneda’s including practical homework lessons given to her in logical steps by her teachers. Castaneda gave much attention to building personal power in order to escape the bounds of the ordinary world of reality. The Hetekas express a greater mission through their teachings: by finding your own song, you contribute to awakening society in order to bring about global healing. Spiritual joys experienced along the way just happen to be a plus.

From Kay’s web site, A World In Balance…

This work is my Path. This is what

I came here to do, to participate in helping

the world, my community, my people. To do that,

I had to first find out about me, help me, heal me,

learn who and what I am, and how I connect

to the whole world. Once I was able to do that,

I had the tools to help someone else.

As the Hetakas have often said to me, it is for each person to objectively reexamine deep inside themselves, their beliefs, their values, and their world, to find THEIR OWN TRUTH – whatever that may be.